As a J-REIT asset management company, we are entrusted with asset management operations for Japan Metropolitan Fund Investment Corporation and Industrial & Infrastructure Fund Investment Corporation.

| Company Name | KJR Management |

|---|---|

| Establishment | November 15, 2000 |

| Capital | 500 million yen |

| Shareholders | KJRM Holdings (100%) |

| Location |

<Kansai Office>

GRAND FRONT OSAKA TowerA, 27th floor, 4-20, Ofukacho, Kita-ku, Osaka-shi Osaka 530-0011, Japan, 530-0011 |

| Board Member |

President & Representative Director Keita Araki Director, Chairman (part-time) Naoki Suzuki Director (part-time) Yasuyuki Matsumoto Auditor (part-time) Hideaki Miyauchi |

| Business Content | Investment management business |

| Registrations, licenses, etc. | Building Lots and Buildings Transaction Business License: Governor of Tokyo (6) No. 79372 Discretionary Transaction Agent License: Minister of Land, Infrastructure, Transport and Tourism, Certification No.58 Financial Instruments Business Operators: Kanto Local Finance Bureau(FIBO) No.403 Member of The Investment Trusts Association, Japan |

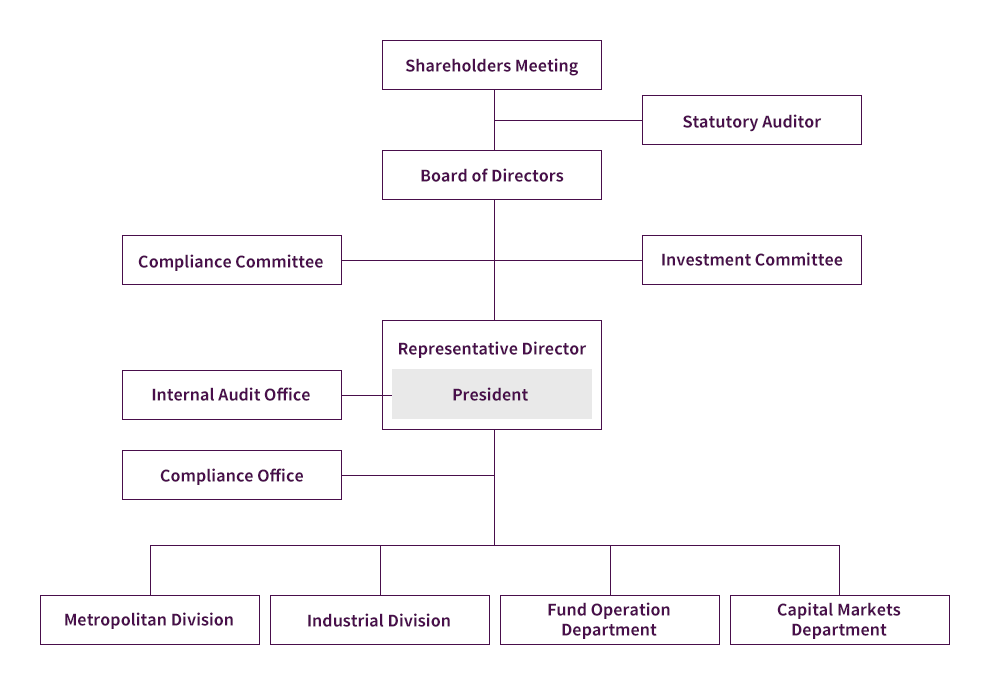

Organization Chart

As of Oct. 2025

Managed Funds

Japan Metropolitan Fund Investment Corporation (JMF)

Japan's largest diversified REIT, which aims to improve investor value (sustainable growth) through investment in urban real estate in Japan, with the philosophy of "supporting urban life in Japan (living, working, consuming)" from a real estate perspective.

Industrial & Infrastructure Fund Investment Corporation (IIF)

The only industrial real estate REIT in Japan that invests in real estate that is expected to be used stably over the medium to long term, with the philosophy of "investing in social infrastructure, which is the source of the power of the Japanese economy, and supporting Japan's industrial activity from a real estate perspective."